Accounts - Expenses

Accounts - Expenses

Shown below is detailed information and a selection of screenshots taken from the Accounts - Expenses section on the QU4D system.

Key Areas of the Accounts - Expenses section

Food and drink information from invoices are automatically submitted to the expenses.

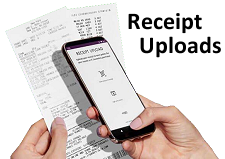

Upload photos of your receipts and and store them directly within your expenses.

Speed up expenses creation by updating your recurring expenses.

Household expenses are also automatically calculated by the number of hours a week you work.

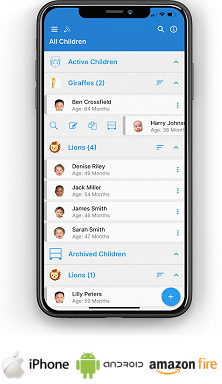

Available on the iPhone and Android apps

The expenses section is available for use by Administrators on the iPhone and Android apps as well as a web browser on a PC, laptop or tablet.

The expenses section is a small part of the complete accounting package on the system.

Screenshots and more Information

Shown below are a selection of screenshots and additional information relating to the Accounts - Expenses section on the system.

Help Video

Shown below is an instructional help video on how to use the Accounts - Expenses section on the system.

Scan the QR code to the right to view this help video on a mobile device, for example a mobile phone or tablet.

Create your monthly expenses

Once you have created invoices for the children in your setting, the food and drink information from within these invoices is automatically submitted to the expenses section on the system, ready to be used within your expenses creation for the month, this facility removes the need for you to keep a manual record of the food and drink that each child has consumed within your setting.

Once you have completed all of your invoices for the month, you can create your expenses for that month, the system will automatically display and calculate all the meals that each child has consumed within your setting for the month, and clearly display a breakdown of this information at the top of your monthly expenses.

To speed up the creation of your expenses each month, it is highly recommended that you complete the recurring expenses section where you can detail all recurring expenses that take place each month, for example, subscription fees, monthly trips out and items that you buy regularly each month.

Each time you create new expenses for a month, the system will first pull in and add all the items within your recurring expenses to the monthly expenses that you are creating, thus saving time having to re-enter the same expenses each month.

Household expenses are also automatically calculated by the number of hours a week you work, you enter this figure within the Accounts General setup section on the system.

Working 40 hours a week you can claim 33% of your Gas and Electricity costs and 10% of Water, Council Tax and Rent each month, this figure will be prorated, so if you work 20 hours per week you can only claim 16.5% and 5% respectively.

You enter the full amount of each household bill within the expenses section and the system will calculate the total amount you can claim as a business expense for the month.

You can now complete the rest of your expenses completing your vehicle and other expenses for the month.

Receipt upload

Each time you add an expense to your monthly accounts you can take a photo of the receipt and upload it directly to the system, thus saving you having to store paper receipts, you can then view the receipt directly on the system, in addition, within the yearly income section you can bulk download your receipts, and the receipts will be saved in a zip file and grouped by the month of the expenses.

Recurring Expenses

To speed up the creation of your expenses each month, it is highly recommended that you complete the recurring expenses section where you can detail all recurring expenses that take place each month, for example, subscription fees, monthly trips out and items that you buy regularly each month.

Each time you create new expenses for a month, the system will first pull in and add all the items within your recurring expenses to the monthly expenses that you are creating, thus saving time having to re-enter the same expenses each month..

IMPRESSED? NOW ALL YOU NEED TO DO IS PURCHASE QU4D

Accounts Setup

Accounts Setup Closure Dates

Closure Dates Expenses

Expenses Funding

Funding Income Monthly / Yearly

Income Monthly / Yearly Invoicing

Invoicing Receipt Upload

Receipt Upload Yearly Terms

Yearly Terms Administrators

Administrators Bulk Download

Bulk Download Children

Children Colour Schemes

Colour Schemes Communicate

Communicate General Notes

General Notes Parental Access

Parental Access Quick Notes

Quick Notes Register

Register Rooms

Rooms