MTD - Making Tax Digital

MTD - Making Tax Digital

Shown below is detailed information relating to HMRC's - Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA), when it will be a requirement for childminders and when it will be released on the system.

What is Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA)?

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) is HMRC’s plan to digitise the tax system for Income Tax Self Assessment for Childminders. MTD aims to make tax returns simpler and more efficient for everyone.

From April 2026 if you have an income of over £50,000 annually, from your self emplyed childminding business, you'll need to:

Use Making Tax Digital (MTD) compatible software.

Go digital with your finances.

Submit your tax returns quarterly.

What is the Making Tax Digital delay?

In December 2022, HMRC announced a delay in Making Tax Digital (MTD) for Income Tax. Instead of launching in April 2024, the first phase of MTD for ITSA will begin in April 2026, for Childminders earning above £50,000.

What is the new start date for MTD for ITSA?

Based on HMRC’s latest announcement, MTD for ITSA will follow a phased approach from April 2026.

Childminders earning above £50,000 will need to comply with ITSA rules from April 2026.

Childminders earning above £30,000 will need to comply with ITSA rules from April 2027.

Why was MTD delayed?

According to HMRC, Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) was delayed to ease the pressure on businesses given the current economic climate. It was also stated that the delay would give businesses more time to adapt to new ways of working.

Is Making Tax Digital going to happen?

Absolutely. Despite the slowdown in pace, digital transformation is still the direction of travel.

Making Tax Digital can help Childminders run more efficiently, use resources more effectively, and save time on day-to-day admin. But right now, businesses are facing considerable challenges in light of economic uncertainty and will benefit from a little extra time to prepare.

Pushing the deadline back gives Childminders more time to get confident about the legislation and learn how to use accounting software like QU4D to improve their overall business health.

Should you prepare for Making Tax Digital (MTD) for (ITSA) now?

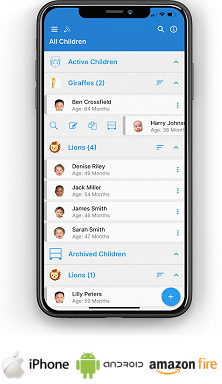

Definitely. Childminders should see the delay as an opportunity to find the right tools and hone their digital skills ahead of the deadline. Instead of pressing pause on your MTD preparations, use this time to learn how you can reap the most rewards from QU4D.

Ready to make QU4D work for you? Click here to purchase a subscription and be digital ready before the deadline.

When will MTD for ITSA be available on QU4D?

As soon as the government publicly release MTD for ITSA, it will be incorporated into the system, this means that by using QU4D now, you'll be ready to submit your tax returns digitally online as soon as MTD is available.

IMPRESSED? NOW ALL YOU NEED TO DO IS PURCHASE QU4D