Accounts - Accounts Setup

Accounts - Accounts Setup

Shown below is detailed information, a help video and a selection of screenshots taken from the Accounts - Accounts Setup section of the QU4D system.

Key Areas of the Accounts - Accounts Setup section

Invoice children on a weekly, monthly or termly basis.

Invoice by the hour, a set fee for the week or the month or by half and full day sessions.

Each child has 5x individual hourly rates.

Each child can have multiple sessions and shift patterns.

Charge separately for each meal that a child eats within your setting.

Expenses are quick and easy to complete, food eaten by children for the month is automatically calculated from the creation of your invoices.

Once your bookkeeping has been setup you can create an invoice for a child with just 4 clicks of a mouse and in less than 15 seconds!

Parents can connect to your system to view and print their invoices.

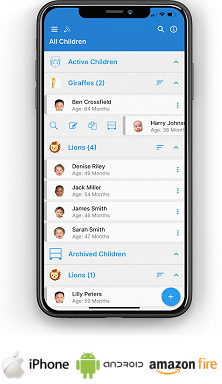

Available on the iPhone and Android apps

The accounts setup section is available for use by Administrators on the iPhone and Android apps as well as a web browser on a PC, laptop or tablet.

The accounts setup section is a small part of the complete accounting package on the system.

Screenshots and more Information

Shown below are a selection of screenshots and additional information relating to the Accounts - Accounts Setup section on the system.

Help Video

Shown below is an instructional help video on how to use the Accounts - Accounts Setup section on the system.

Scan the QR code to the right to view this help video on a mobile device, for example a mobile phone or tablet.

Accounts - Accounts Setup

Invoice Contact Information

The contact information you enter within this section will appear on each invoice that you create for a child.

Working hours per week

You must select your average working hours per week, up to a maximum of 40 hours.

The business expense part of your household bills will be calculated using the number of hours a week you work, this calculation is based on the number of hours a week you work.

For example, working 40 hours a week you can claim 33% of your Gas and Electricity costs and 10% of Water, Council Tax and Rent each month, this figure will be prorated, so if you work 20 hours per week you can only claim 16.5% and 5% respectively.

Payment options

You must select the payment options that you will accept for payment of Children's invoices, these payment options will be clearly displayed on their invoices and can be adjusted on a per child basis when you edit their individual settings.

Contracted Hourly Rates

You must enter the standard contracted hourly rates that you usually charge within your setting, these rates can be your standard hourly rate, time and a half charge or any other rate, by default Rate 1 will be charged on creation of your invoices, however, Rate 2 to Rate 5 can be selected for each individual day.

The rates you enter can be adjusted on a per child basis when you edit their individual settings.

Half Day / Full Day Rates

If you invoice for childcare using half day and full day rates, you enter the number of hours that are included within your half day rate and then enter your half day rate, below this enter your full day rate that will be charged if the number of hours of childcare in a session exceeds the number of hours included within your half day rate.

You can also invoice additional hours for any day using one of your five individual hourly rates.

Before / After School Rates

If you provide before and after school care, enter the rates you charge for each session, each session is not related to a set number of hours, it is a set rate for morning or afternoon care regardless of the number of hours you care for the child.

Session Rates

If you charge a session rate for specific care, you can add session rates, each session can be related to any number of hours and any session can be selected when creating a child's invoice.

Childcare Funding Rates

If you receive childcare funding for 2 and 3/4 year olds, you enter the rates you receive for each age range.

When creating an invoice for a child on the system all funded hours will display as a zero rate for parents.

Food and Drink Allowance

For each meal that you provide a child in your care you can claim this back through your expenses, you enter the specific set amount for each individual meal that they are provided with throughout the day, and when you create your expenses, the system knows which children were provided each meal and this information will be displayed within your expenses.

In addition, if you charge extra for meals, the figures you enter will also be used within each child's individual monthly invoice, you can specify for each child if they should be charged for meals and which meals they should be charged for.

For example: If you have calculated that it costs £2.00 to create lunch for each child in your setting aged between 12-60 months, enter £2.00 in the lunch column for 12-60 Months below.

Vehicle Expenses

Expenses will be calculated for each mile travelled OR for a % of the total running costs for the vehicle.

Pence per mile

You may claim each mile you travel at 45 pence per mile up to 10,000 miles per year and at 25 pence per mile over 10,000 miles per year.

% of vehicle expenses

You may claim a % of your vehicle's expenses, so if you use your vehicle 75% of the time for your business you may claim 75% of the total running costs of the vehicle.

Upload a Logo

You may upload a logo that will be displayed on each invoice that you create on the system.

IMPRESSED? NOW ALL YOU NEED TO DO IS PURCHASE QU4D

Accounts Setup

Accounts Setup Closure Dates

Closure Dates Expenses

Expenses Funding

Funding Income Monthly / Yearly

Income Monthly / Yearly Invoicing

Invoicing Receipt Upload

Receipt Upload Yearly Terms

Yearly Terms Administrators

Administrators Bulk Download

Bulk Download Children

Children Colour Schemes

Colour Schemes Communicate

Communicate General Notes

General Notes Parental Access

Parental Access Quick Notes

Quick Notes Register

Register Rooms

Rooms